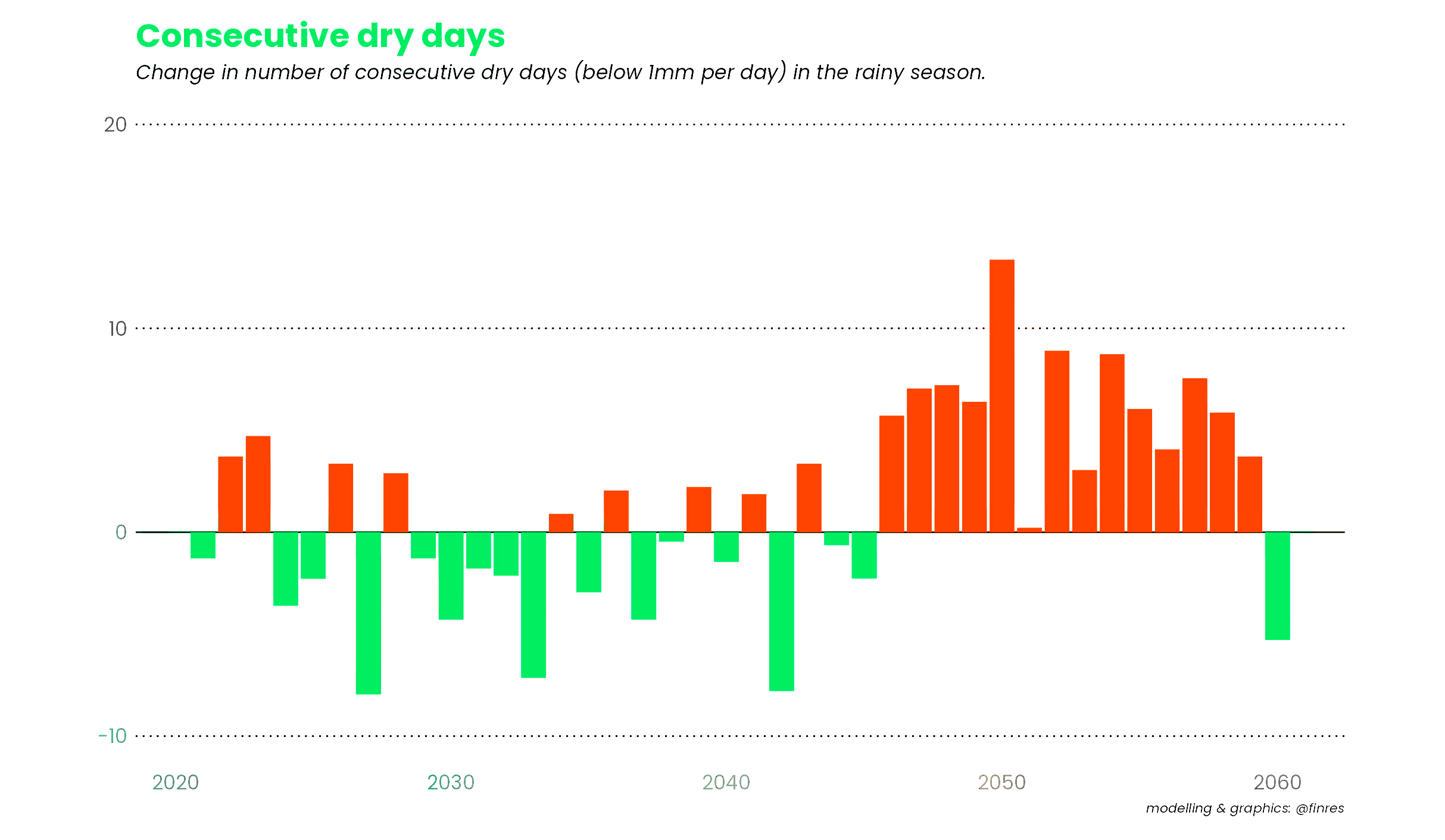

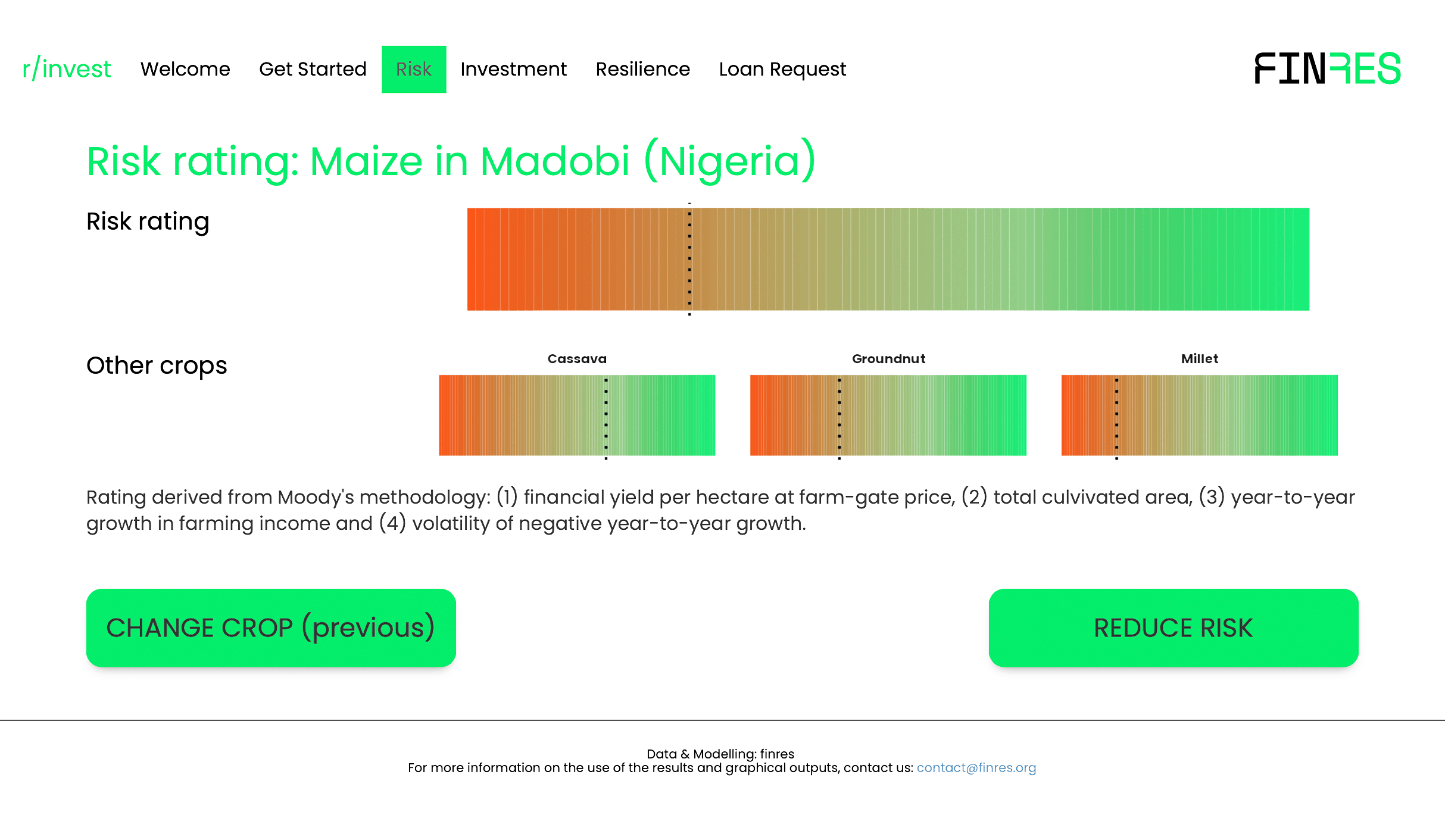

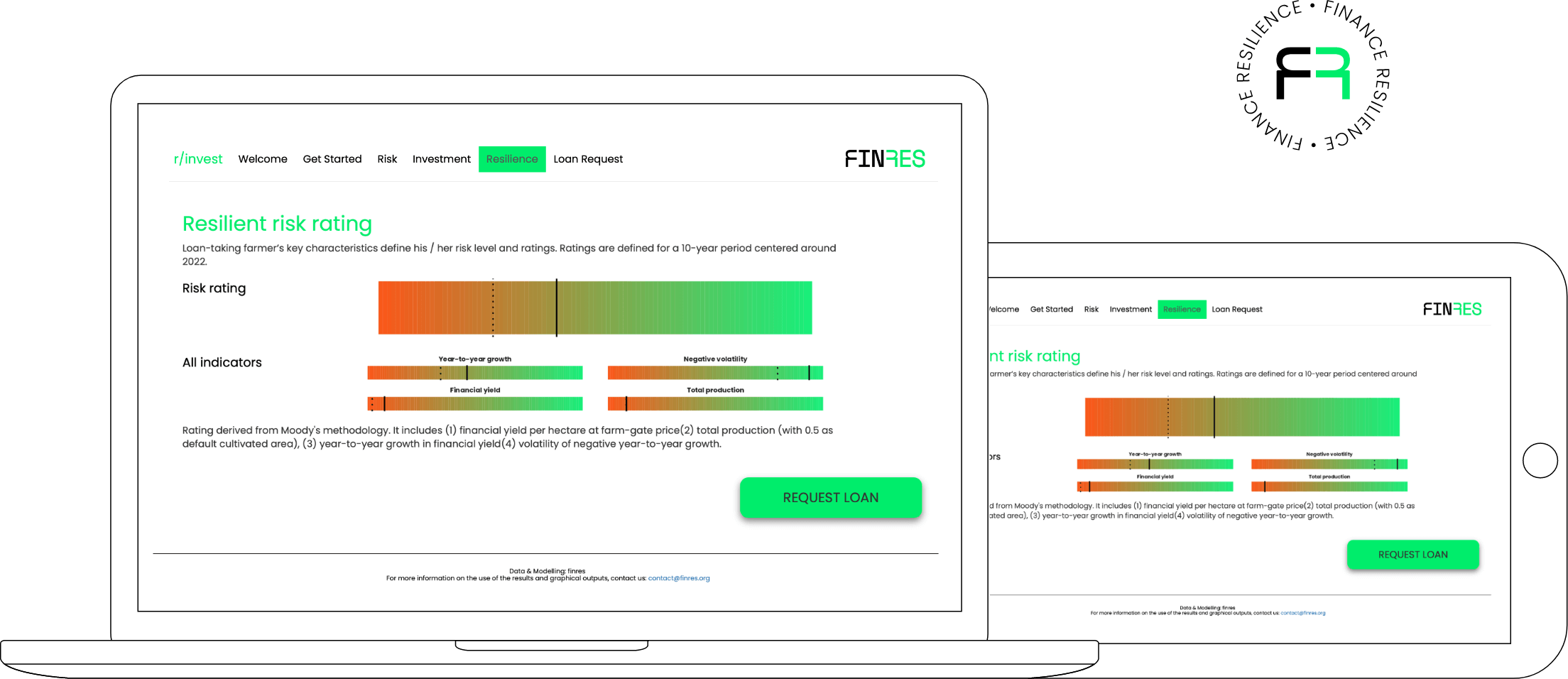

Climate change is the primary risk that financial institutions face in the agriculture sector. Finres offers comprehensive, granular modeling of this risk, quantifying its financial impact (r/rating). finres thus enables its integration into risk management policies, taxonomy and governance frameworks.

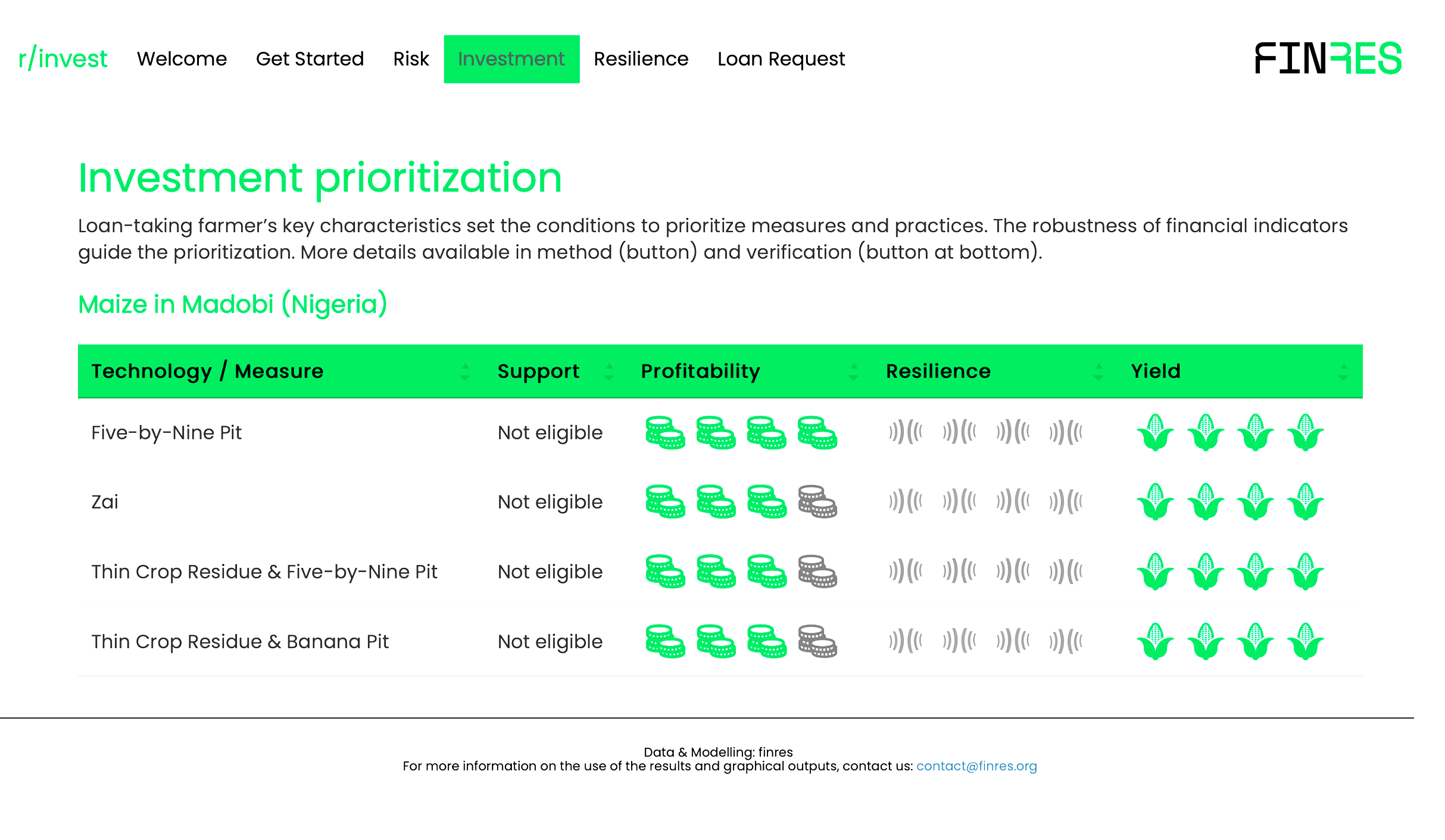

finres solutions also make it possible to prioritize investments in the face of climate constraints according to a logic of profitability and robustness (r/invest). Choosing the adaptation technology that will deliver – with the highest probability – the best return on investment for a given crop and territory is now within reach.